SafetyĪlong with savings accounts and money market accounts, CDs are some of the safest places to keep your money. Here are some of the main benefits or advantages of saving money with certificate of deposit accounts. There are several reasons why you may consider using a CD for managing your savings goals. Pros of Using a Certificate of Deposit for Savings However, it’s important to note that many banks automatically roll your savings into a new CD at the end of the term if you don’t specify that you want to make a withdrawal.

#CERTIFICATE DEPOSIT RATE VIBE CREDIT UNION FREE#

Once a CD matures, you’re free to withdraw the money you saved, along with interest earned. Bump-up and step-up CDs, for example, offer the opportunity to raise your rate once or twice during the CD term. The annual percentage yield (APY) for CDs is typically fixed, meaning you earn the same rate for the entire CD term.

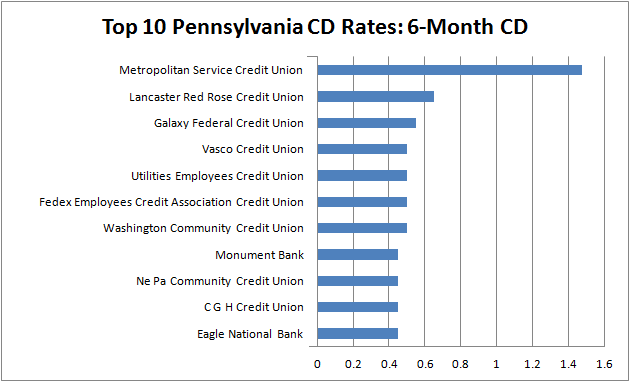

Some banks may, however, offer promotional CDs that feature higher rates with shorter terms. As a general rule of thumb, the longer the CD term, the higher the interest rate you can earn. You’ll also have to choose a CD term, which is the length of time you agree to keep your money tied up in the CD.ĬD terms can range from as little as 28 or 30 days up to 10 years or more, depending on the bank or credit union. Opening a CD account is similar to opening a savings account in that there may be a minimum initial deposit you’re required to make. CD accounts, on the other hand, operate under the assumption that you won’t withdraw any money until the CD matures. For instance, with those accounts, you can generally make up to six withdrawals per month if needed. A CD allows you to hold money for a specific amount of time while earning interest.Ī CD can be used as a savings vehicle, but it isn’t the same as a savings account or money market account. What Is a Certificate of Deposit?ĬDs are time deposit accounts offered by brick-and-mortar banks, credit unions and online financial institutions. Please click here to see your rate before applying. Up to 4.90% Annual Percentage Yield (APY) for 11 months.Up to 4.80% Annual Percentage Yield (APY) for 7 months.On 03 to 05 year Fixed Deposits, interest can be earned monthly, quarterly, bi-annually, annually or at maturity.ĮFDs placed via ComBank Digital & Flash Digital Bank Account will receive a higher interest rate than the standard interest rate for 3,6,12 months eFDs (Available only for eFDs with interest paid at maturity).Get special CD rates with U.S.On 02 year deposits interest could be paid monthly, annually or at maturity.If you place a Fixed Deposit for a period of 1 month to 6 months, interest will be paid only upon maturity.You can earn interest monthly or at maturity, when you place a Fixed Deposit for 01 to 05 years.The interest rate of the Fixed deposit will remain unaffected until the deposit maturity.This special facility is offered for Fixed deposits with a value of Rs 100,000/- or above and a deposit period of over 1 year.The cash advance amount can be withdrawn any time through your debit Card from ATMs located islandwide.You can receive up to 90% of your Fixed Deposit as a cash advance.If you are already registered for our ComBank Digital Banking facility, you can place Fixed Deposits online at any convenient time, by directly debiting your account.You can request the Bank to renew your deposit at maturity, with interest earned added to the capital or renew just the capital.You can earn a higher rate of interest.Margin Trading and Transaction Processing Services.Structured Debt Products Including Securitizations.Structuring and Managing Warrants and Hybrid Capital Issuances.Structuring and Managing Secondary Public Offerings and Rights Issuances.Structuring and Managing Private Placements of Equity.Commercial Agri Loans For Professionals.

#CERTIFICATE DEPOSIT RATE VIBE CREDIT UNION PLUS#

Personal Foreign Currency Fixed Deposits.Foreign Currency Children’s Savings Account.

0 kommentar(er)

0 kommentar(er)